What is a predetermined-Speed Financing? How can i Determine It?

A fixed-price financing has an interest price that doesn’t transform whatsoever over the course of the loan title. Brand new payment per month stays an equivalent every month, that produces monthly or yearly cost management basic predictable for individuals. Fixed-rates mortgage loans are apt to have highest costs than changeable rate loans, even so they including include people from movement regarding construction , the latest gap between varying prices and you may repaired prices has practically finalized, meaning fixed rates is going to be just as reasonable because the changeable cost.

In the event the interest levels in the market improve, you might not getting inspired and will not need to bother about your own notice can cost you otherwise home loan repayments expanding. Discover a fixed rate of interest for some label solutions, also 15-12 months and you may 31-12 months terms and conditions. Which have a fixed price, when you first begin purchasing the financial, your very early costs were mainly attention in place of principal. Typically, your own commission have a tendency to gradually are much more prominent than notice. This process is known as mortgage amortization.

This doesn’t change the measurements of your payment, and therefore remains consistent monthly before the financing harmony is actually totally reduced.

A predetermined-speed loan is a superb option for a borrower who would like the stability regarding a frequent monthly payment and you can would like to prevent the risk of an adjustable rate of interest that can cause increased payments.

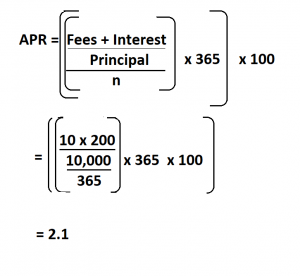

So how do you assess your fixed-rates financing? You have to know the amount of the mortgage as well as the mortgage repayment grounds. New algorithm of these loans are: Mortgage Commission = Amount/Dismiss Foundation.

- Number of occasional money (n) = money a-year moments long-time

- Unexpected Interest (i) = yearly speed split up from the number of money for every single

- Discount factor (D) = <[(1>/ [i(1 + i)^n]

This can include their real estate loan number, your annual interest rate, the amount of months of one’s loan label and your wanted amortization schedule.

To use the newest calculator, you’ll very first input the mortgage loan recommendations

Next, you can submit your home guidance. For example this new selling price of the property, your own yearly property taxation, their annual danger insurance policies plus month-to-month individual financial insurance coverage. You may opt to assist our bodies estimate your residence taxes, threat insurance rates and private mortgage insurance coverage to you.

After you have occupied in all brand new appropriate advice https://speedycashloan.net/payday-loans-tx/, strike Estimate, and we’ll leave you the projected monthly obligations and you will a quote from exactly how much you’ll be able to pay inside the appeal along the lifetime of the mortgage. Find out how close your appeared after you determined the fresh estimates oneself.

How to Calculate an appeal-Just Financing Estimate?

Interest-just loan rates is actually notably less tricky so you can estimate. With each commission, you’re not in fact paying off the loan. Loan providers basically checklist rates of interest as the yearly data, so you’ll divide the interest rate because of the several each month out of the season in order to estimate exactly what your month-to-month rates is. The fresh formula having a destination-only mortgage try:

Such, if the rate of interest is actually six per cent, you’d split 0.06 by the a dozen to acquire a monthly price out of 0.005. You’d then proliferate it amount by the level of the financing to help you calculate your loan percentage. Should your amount borrowed is actually $100,000, might multiply $100,000 by 0.005 to have a payment regarding $five hundred.

A less strenuous formula ount off $100,000 by interest off 0.06 to locate $six,000 regarding yearly focus, next isolating one to $six,000 of the 12 to truly get your payment away from $five-hundred. Regardless of hence approach you choose, you’ll be able to nonetheless end up with an equivalent really worth.

Your own percentage number will stay the same if you don’t make an enthusiastic even more payment, just after a particular several months if you are required to make a keen amortizing payment or if you pay-off the entire loan.